Elliott Wave Patterns & Fibonacci Relationships Core Reference Guide

August 27, 2018

29 min read

Elliott Wave Theory attempts to identify recurring price movements within financial markets and to classify them into a set of meaningful patterns, which can become a reliable tool for future price predictions. The underlying principle is that price-action unfolds via an endless alternation between trending and corrective cycles, while producing this effect on any relative timescale (fractality).

Elliott Wave (EW) price patterns are divided into motive waves (i.e. price movements that initiate progress in one direction and therefore create trend) and corrective waves (i.e. price movements that are reactionary in relation to the previous trend-setting move). Corrective waves essentially attempt to revert or undo the movement that was initiated by the preceding motive wave.

How to use this guide

This EW reference guide provides an idealized drawing for each EW pattern, including a visualization of the most important internal wave size relationships. The images highlight the most common wave retracement and extension targets in red, followed by the next most common targets in orange, followed by the least common targets in grey.

Important Concepts To Remember Before Applying EW Counts

Wave Degrees

Elliott Waves are labeled in different degrees that are nested within each other due to the fractal nature of price movements. Please refer to your Elliott Wave drawing software for the appropriate names and symbols used for each officially defined degree. Alternatively, you may simply label different degrees with different-colored labels on your chart.

Alternation (“expect a difference in the next expression of a similar pattern”):

EW patterns have the tendency to create alternation within them. This is reflective of nature’s general propensity towards dynamic balance. Following is a list of the main occurrences of alternation:

Alternation of corrective waves:

- If wave 2 is sharp (i.e. zigzag or extended zigzag) and deep (i.e. deep in the sense of how much it retraces the preceding wave 1), then wave 4 will most likely going to be sideways (flat, combination, or triangle) and shallow relative to wave 3. The same applies in reverse but is less common. This is because triangles (which only appear during wave 4 inside a motive wave) are considered to be alternating to all other corrective patterns. That means even if wave 2 is a shallow sideways correction, a triangle can still appear in wave 4, but it is less likely.

- Alternation also occurs in terms of wave complexity. If a potential bigger complex correction starts out simple at first, then expect complexity to increase during the following parts of the correction (i.e. simple-complex-most complex). The reverse can also apply (i.e. most complex-complex-simple) but it is more rare.

Alternation of motive waves:

- If wave 1 is short, then wave 3 is likely to be extended, and wave 5 likely to be short again. If wave 1 is extended, then wave 3 and 5 are most likely not extended. If neither wave 1 nor wave 3 is extended, then wave 5 probably will be extended. If wave 3 is extremely long and overstretched, wave is 5 more in danger of being truncated.

Balanced Proportions (“The Right Look”):

It is important that waves within a 5-wave or 3-wave sequence show reasonably balanced proportions to each other… not just in terms of size/magnitude (which can generally be verified by Fibonacci retracement and extension ratios), but also in terms of time duration. This balancing can occur either via alternation and/or via equality.

Consider the following as an example for ‘balance through alternation’: an impulse is showing a classic deep and short-lived wave 2, plus a shallow but time-lengthy wave 4. The time-lengthiness of wave 4 is in balance with the depth of wave 2, while the shallowness of wave 4 is in balance with the short-lived nature of wave 2, thereby creating balance through alternation.

The same need for balance applies for any motive waves within a 5-wave sequence (i.e. 1,3, and 5). The exception however will be the potentially extended wave within the sequence. It can/will be much larger in terms of magnitude and time than the other four waves, but the sub-waves (inside the extended wave) must show a balance to each other. The extended wave will also express relatedness to the other waves of the sequence by the angle of the overall price movement (that’s why impulsive motive waves travel quite neatly within parallel channel lines most of the time, even if one of the waves is extended).

Consider the following as an example for ‘balance through equality AND alternation’. Wave 1 and 5 of an impulse sequence are equal in size and duration (equality), while wave 3 is extended (alternation to waves 1 and 5).

Alarm bells should be going off when a potential wave 4 is starting to grow out of proportion in terms of size and duration relative to the other waves of the same degree.

It is dangerous to disregard the factor of balanced proportions during wave counting. Disproportionate and misshapen patterns should be seriously questioned.

The ‘right look’ may not be evident at all degrees of trend simultaneously, so it is best to focus on the degrees that are the clearest.

Motive Wave: IMPULSE

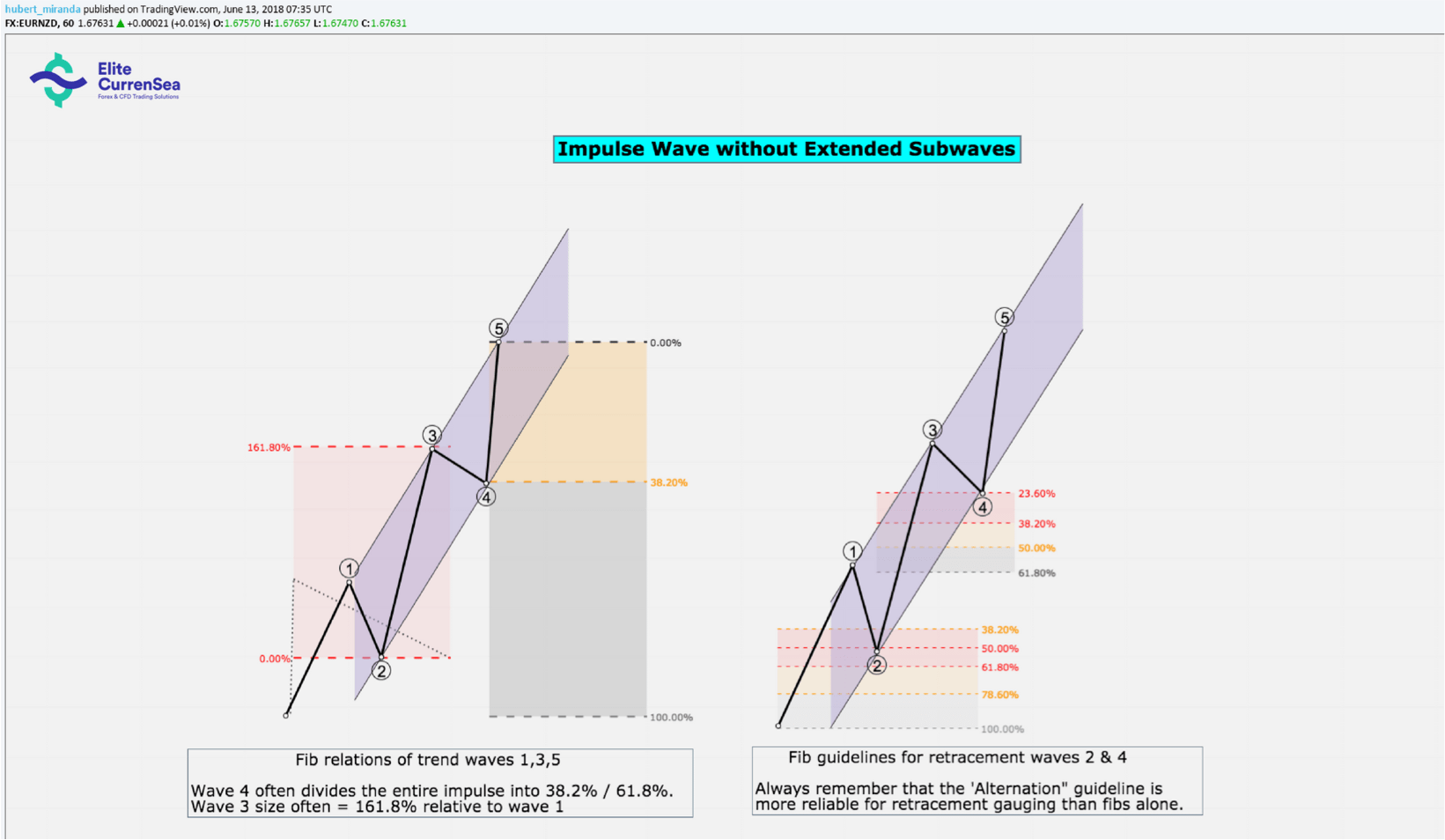

Note: The percentages in the above for Fibonacci extension targets are drawn from the start of the wave, but the ratios are based on the size of the preceding motive wave (i.e. targets of 3 are relative to the size of wave 1, targets of wave 5 are relative to the size of wave 3.

- An impulse consists of 5 internal waves.

- Wave 1 and 5 always have to be impulses or diagonals

- Wave 3 always has to be an impulse by itself (i.e. can’t be a diagonal)

- Wave 3 must never be the shortest (in terms of percentage gain/loss) within the sequence

- Wave 2 is always a corrective pattern and must not retrace more than 100% of wave 1

- Wave 2 can be any corrective pattern except a triangle (but it can be a complex combination (wxy or wxyz) that ends with a triangle)

- Wave 4 must not enter the price territory of wave 1

- Wave 4 must always be a corrective pattern (any)

Guidelines:

- Waves 2 and 4 tend to create alternation between each other (as outlined in the introduction of this guide)

- Wave 2 usually retraces to deeper levels of wave 1 than wave 4 does relative to wave 3

- Wave 2 develops more commonly as a simple corrective pattern (i.e. zigzag or double/triple zigzag)

- Wave 4 develops more commonly as a complex corrective pattern (i.e. triangle, double/triple threes, flat)

- In almost all impulses, one of the action waves (1,3, or 5) becomes extended, and it is most commonly wave 3

- Extended waves can contain several further extensions within them

- Wave 5 can fail to go beyond wave 3 (truncation) but it is not very common. It usually happens when wave 3 has been exceptionally long and overstretched. Truncation often results in significant reversals.

- Wave 5 is most likely not going to form a diagonal if wave 3 is not extended

- An impulse is not over until all sub degrees are finished (e.g. 5 of 5 of 5). The wave count takes precedence over channel lines and Fibonacci targets

- Wave 3 almost always exhibits the greatest volume. If volume during the 5th wave is as high as the 3rd, expect an extended 5th wave.

Fibonacci Retracement and Extension Guidelines:

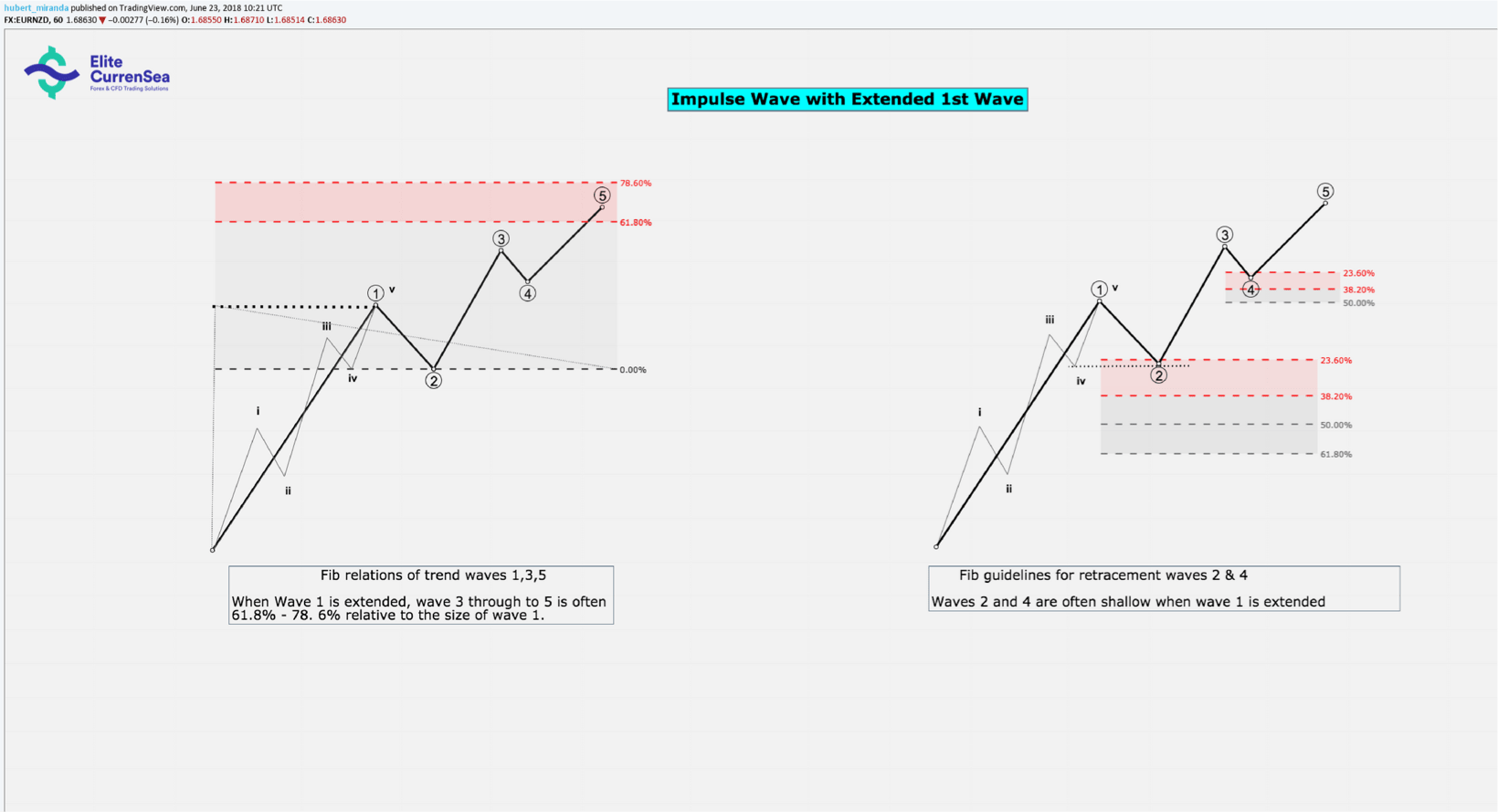

- If wave 1 is extended, then the size of wave 3 through to the end of wave 5 is often 61.8% – 78.6% relative to the size of wave 1

- If wave 1 is extended, then wave 2 and 4 are very likely to be shallow (i.e. 23.6% – 38.2%)

- If wave 1 is extended, then wave 2 will often end at the level of sub-wave 4 of 1 (i.e. the internal wave 4 of wave 1)

- If wave 2 retraces more than 78.6% of wave 1, the idea that it really is a wave 2 becomes more doubtful (possible A-B?)

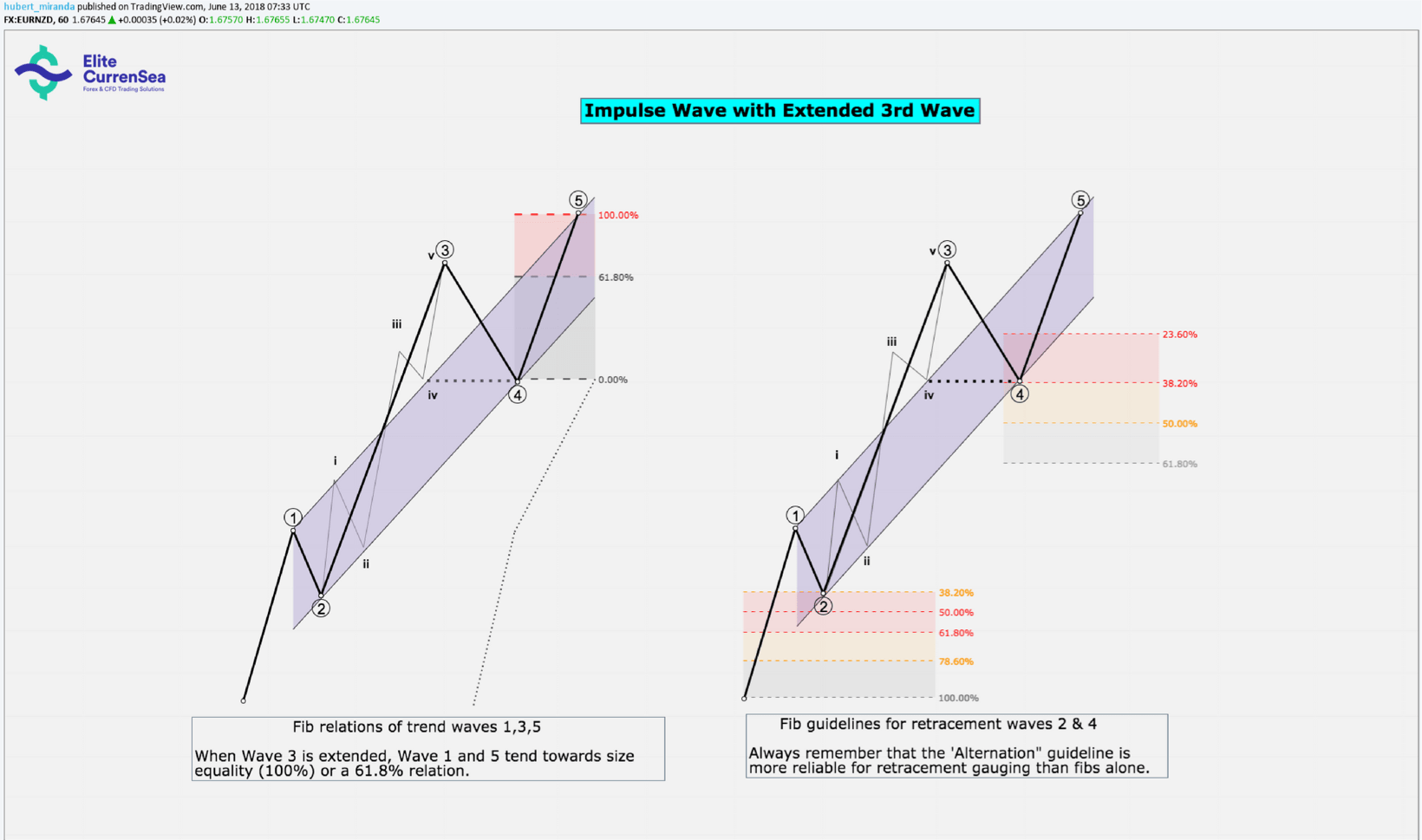

- If wave 3 is extended, then wave 1 and 5 are often nearly equal in magnitude and duration. If equality is lacking, a 61.8% relationship is next most likely.

- If wave 3 is extended, then wave 4 often ends at the level of sub-wave 4 of 3 and is quite shallow (retraces 23.6% – 38.2% of wave 3)

- If wave 3 is extended and very vertical, it will likely overshoot the trend channel that can be drawn when placing the anchor points at the extremities of wave 1, 2 and 4. However the channel is still very valid for gauging the end of wave 5 (see image)

- If wave 4 retraces more than 50% of wave 3, it is quite often not a wave 4.

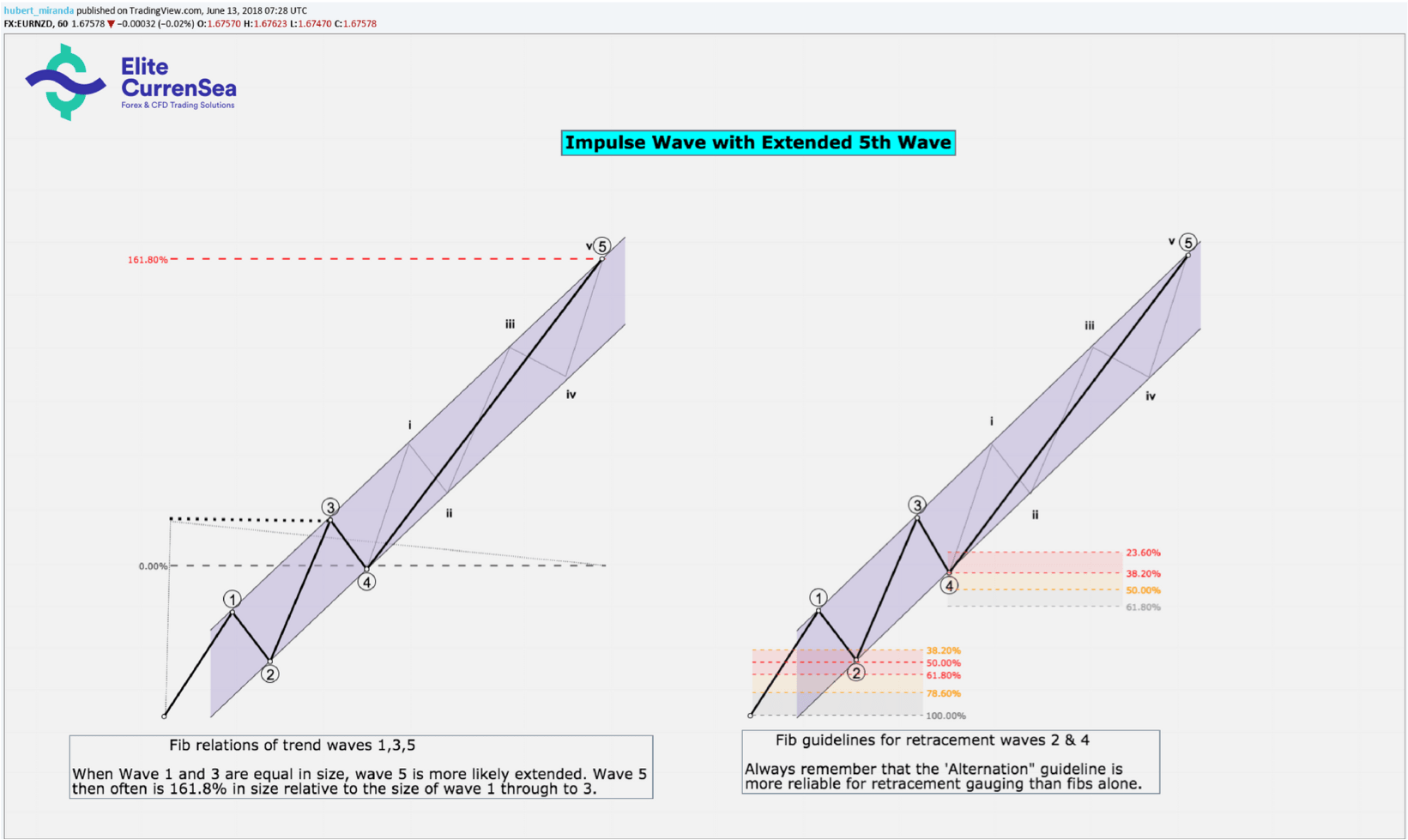

- Wave 5 is likely to become extended if wave 1 and 3 are equal in size.

- If wave 5 is extended, then it often finishes at the 161.8% extension relative to the magnitude of wave 1 through to 3 (see image)

- If wave 5 is extended, then the ensuing correction is often sharp and swift and ends near the extreme of sub-wave 2 of the extension. This does not apply when the market is ending a 5th wave simultaneously at more than one degree.

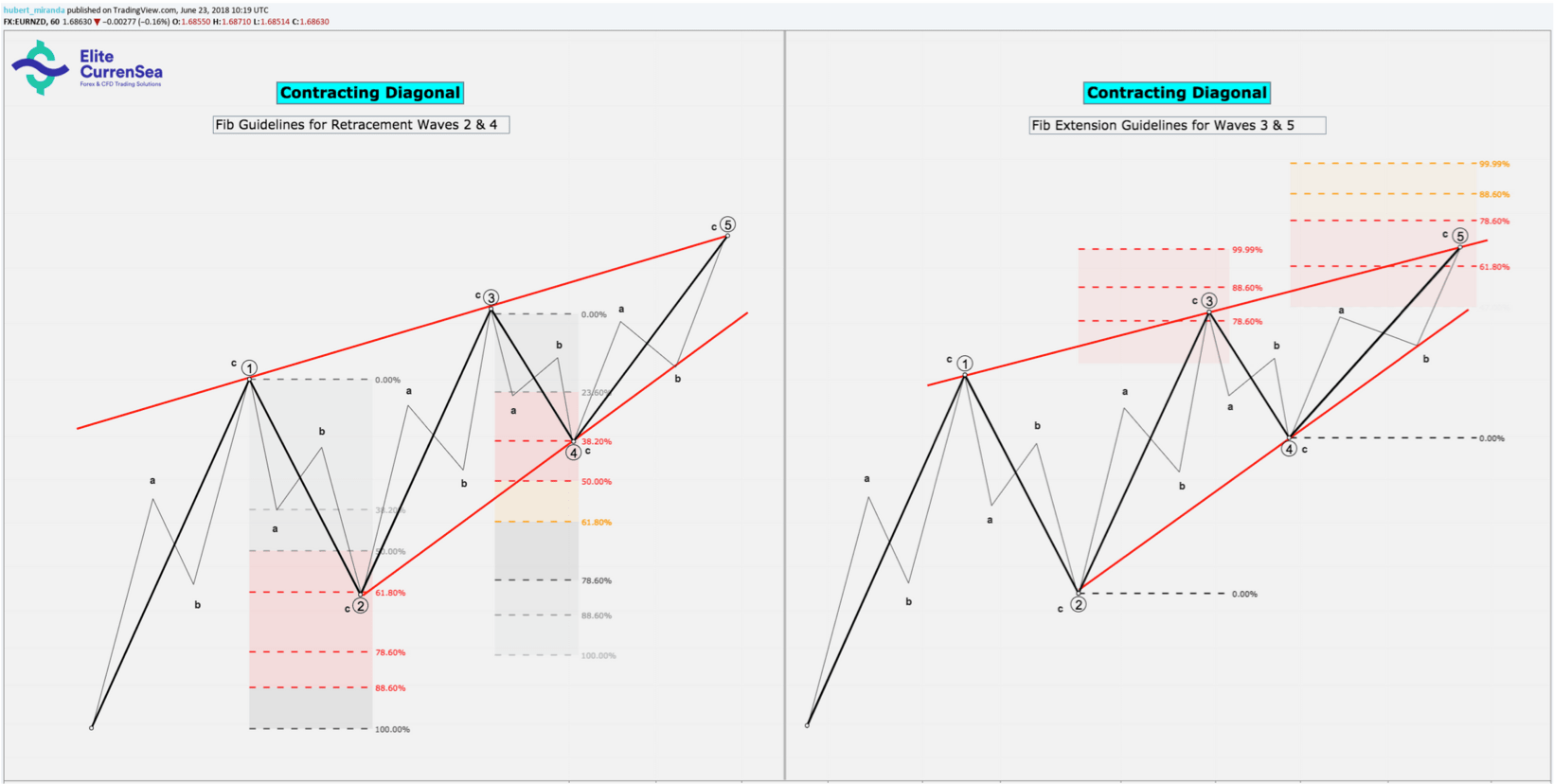

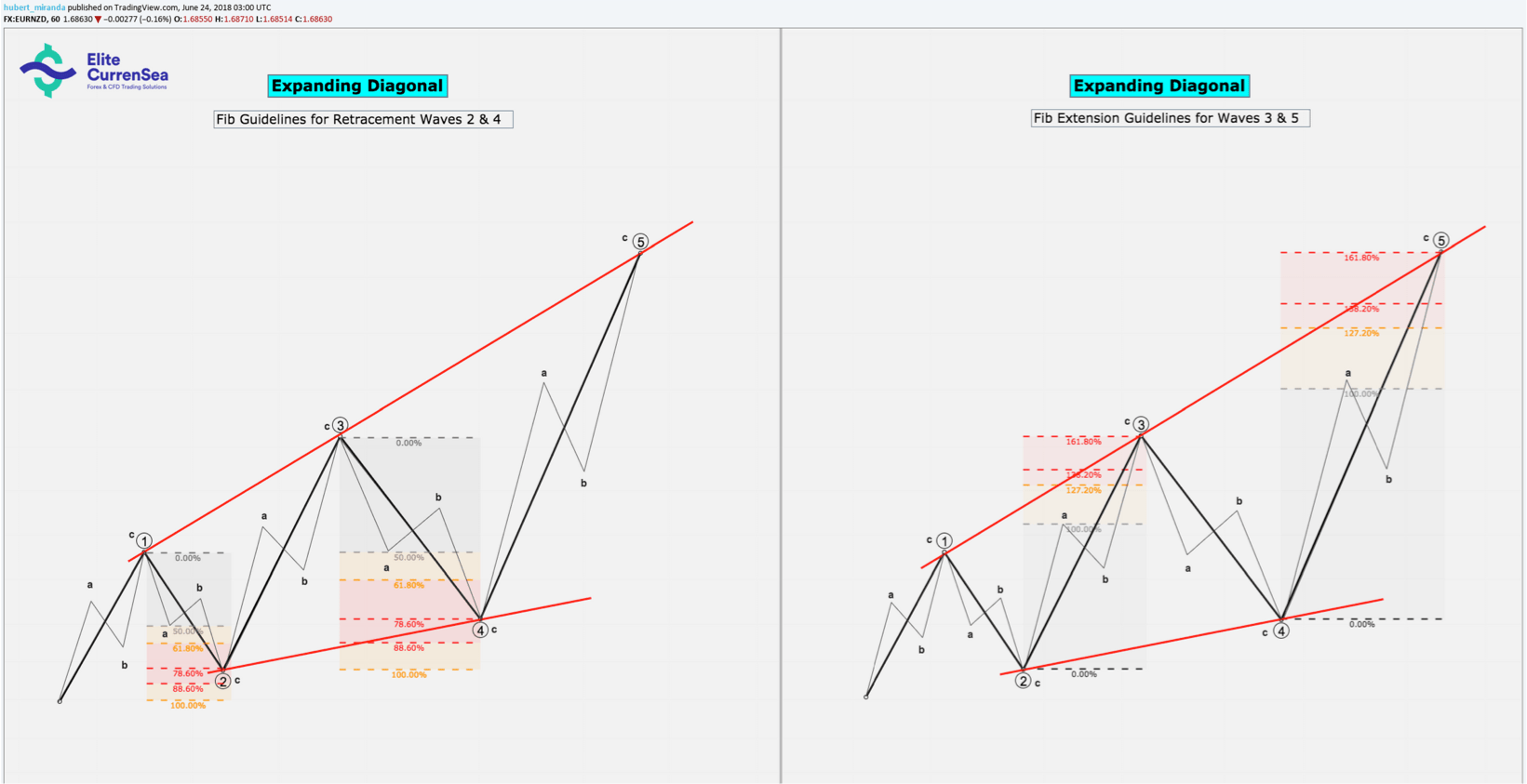

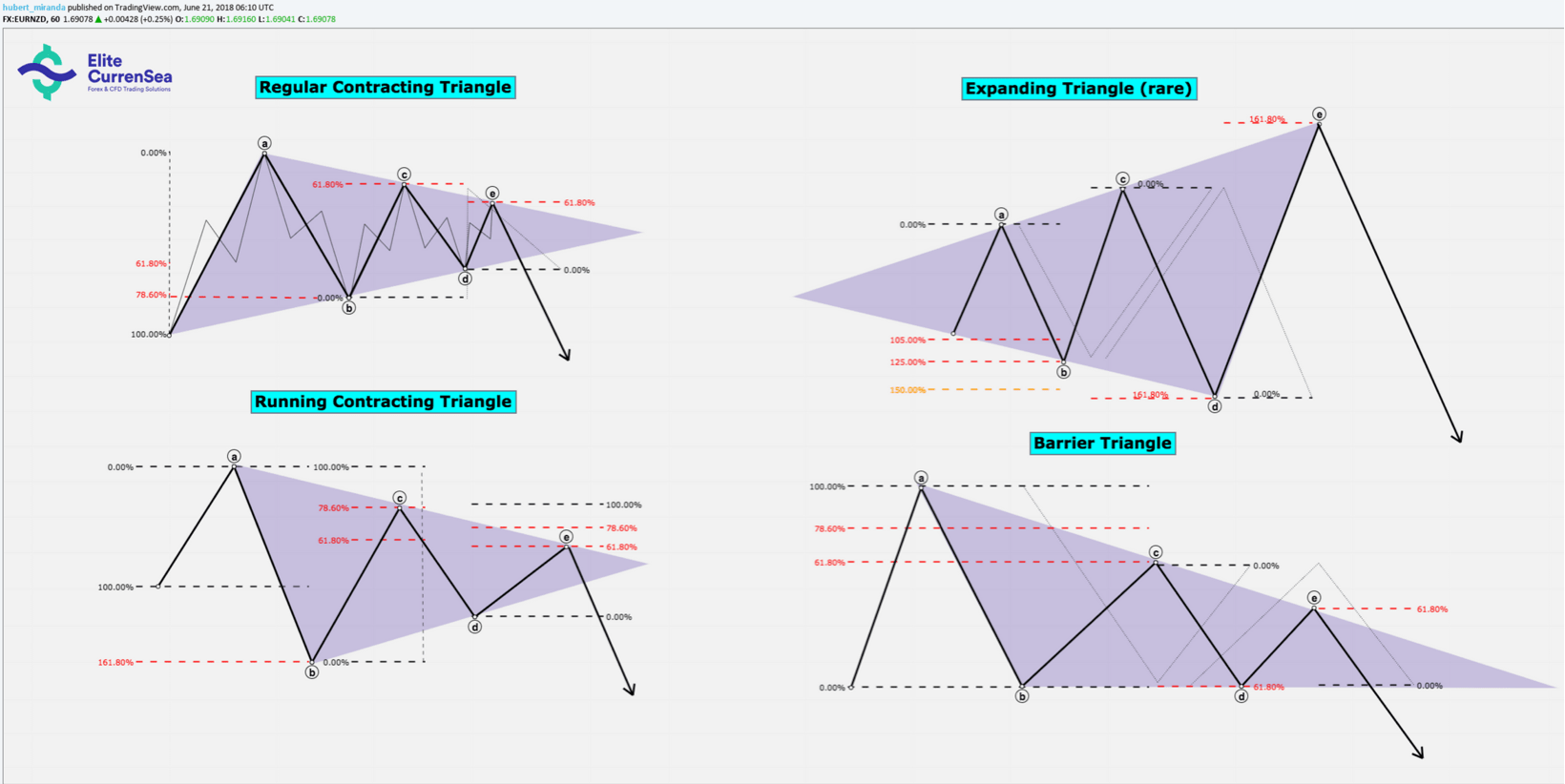

Motive Wave: DIAGONAL

Note: The percentages in the above for Fibonacci extension targets are drawn from the start of the wave, but the ratios are based on the size of the preceding motive wave (i.e. targets of 3 are relative to the size of wave 1, targets of wave 5 are relative to the size of wave 3.

Note: The percentages in the above for Fibonacci extension targets are drawn from the start of the wave, but the ratios are based on the size of the preceding motive wave (i.e. targets of 3 are relative to the size of wave 1, targets of wave 5 are relative to the size of wave 3.

Rules:

- All diagonals consist of 5 waves

- Diagonals can be ‘leading’ or ‘ending’ diagonals, depending on whether they form at the start or end of a trend. Diagonals therefore can only form in the positions of wave 1 (leading) or 5 (ending) of an impulse, or the positions of wave A (leading) or C (ending) of a zigzag.

- Within an ending diagonal, all 5 waves must be zigzags (simple-, double-, and triple-zigzags are all valid)

- Within a leading diagonal, at least waves 2 and 4 must be zigzags (simple-, double-, and triple-zigzags are all valid). Waves 1, 3 and 5 can be impulses or zigzags. (If 1, 3, and 5 are impulses, be aware that it could easily be a 1-2, 1-2, 1-2 sequence instead of a diagonal)

- Wave 2 must not retrace more than 100% of wave 1

- Wave 4 must overlap with wave 1(please note that opinions differ over this rule. There are some Elliott Wave researchers who believe that ending and leading diagonals can be valid without wave 4 needing to move into territory of wave 1, although they still consider it unusual)

- Wave 4 never moves beyond the end of wave 2

- Leading and expanding diagonals must not have a truncated 5th wave.

- Contracting diagonals always have a shorter wave 3 than wave 1 (in terms of percentage gain/loss)

- Contracting diagonals always have a shorter wave 5 than wave 3 (in terms of percentage gain/loss)

- Contracting diagonals always have a shorter wave 4 than wave 2 (in terms of percentage gain/loss)

- Expanding diagonals always have a longer wave 3 than wave 1 (in terms of percentage gain/loss)

- Expanding diagonals always have a longer wave 5 than wave 3 (in terms of percentage gain/loss)

- Expanding diagonals always have a longer wave 4 than wave 2 (in terms of percentage gain/loss)

Guidelines:

- Contracting diagonals form within two converging trend lines (contracting wedge)

- Contracting diagonals can overshoot its trend line during wave 5 (called throw-over) and still be valid as long as wave 5 remains smaller than wave 3

- Contracting ending diagonals can also undershoot its trend line during wave 5 (truncation).

- Contracting ending diagonals should always show a corresponding decrease in momentum as they progress towards their culmination. Many small candles that take a lot of time to gain further ground is a good sign that an ending diagonal is indeed occurring. Conversely, strong big candles within a potential diagonal formation should be a warning sign that you are probably witnessing a 1-2, 1-2, 1-2 extension of the trend, and therefore not an ending diagonal.

- Expanding diagonals form within two diverging trend lines (expanding wedge). They are more rare than contracting diagonals

- Wave 2 and 4 of any diagonal very often retrace their wave 1 and 3 much deeper when compared to wave 2 and 4 of impulses

- The internal zigzags of any diagonal can sometimes subdivide into more complex double or triple zigzags

- Any diagonal can begin to be confirmed with higher certainty once wave 4 is close to being complete

- Diagonals are more rare in general (although they do occur quite frequently within sub-waves of very small wave degrees that are visible on timescales of M15 and lower)

- If wave 1 is a leading diagonal, wave 3 is usually extended.

- A place to watch out for potential expanding leading diagonals is at the start of stock market declines (due to the opposing forces that are in play during this transitional period). Diagonals occur because of transitory forces of trend changes act against each other

- Ending diagonals are followed by a strong reversal most of the time

Fibonacci Retracement and Extension Guidelines: Refer to image for key retracements and extension targets

Corrective Wave: ZIGZAG

Note: The percentages in the above for Fibonacci extension targets are drawn from the start of the wave, but the ratios are based on the size of the preceding wave of the same direction (i.e. targets of C are relative to the size of wave A, targets of wave Y are relative to the size of wave W, targets of wave Z are relative to the size of wave Y.

Rules:

- Zigzags consist of 3 waves (A, B and C)

- Wave A must be an impulse or leading diagonal

- Wave C must be an impulse or ending diagonal

- Only one diagonal is allowed (A or C) per zigzag, i.e. it must have at least one impulse (A or C)

- Wave B can be any corrective pattern (zigzag, flat, triangle, complex combination)

- Wave B must not retrace Wave A by more than 100%

Guidelines:

- Wave C should normally always go beyond A. Wave C can in principle be truncated (i.e. not go beyond wave A) but it is extremely rare.

- Zigzags can become extended into double or triple zigzags, in which case they are labeled wxy (double zigzag) and wxyz (triple zigzag). W, Y, and Z will each subdivide into their own ABC zigzag, while the X wave/s can be any corrective pattern (they take on the same role as B waves in a simple zigzag). Extended zigzags usually form when a simple zigzag appears too small in terms of time and magnitude in order to be proportional to the swing, which it is correcting.

- Zigzags can take many shapes and sizes. One of the features that can help distinguish an A-B-C zigzag from a potential 1-2-3 impulse is that wave A and B will be much more overlapping in general and A waves tend to finish quicker than wave 1 in terms of time and magnitude. Zigzags should often show a very gently sloping channel, whereas 1-2-3 are typically much more steep

Fibonacci Retracement and Extension Guidelines:

- Waves A and C of a correction tend towards equality (same size 100%). The next most common ratios are C = 161.8% x A or C = 61.8% x A

- Wave B usually retraces between 38% – 79% of wave A

- If wave B is a triangle, there is a higher chance that wave C may only reach the 61.8% extension target.

- If wave B is a running triangle, it will typically only retrace 10 – 40% of wave A

- If wave B is any other sideways correction, it will typically 38% – 50% of wave A

- if wave B is a zigzag, it will typically retrace 50% – 79% of wave A

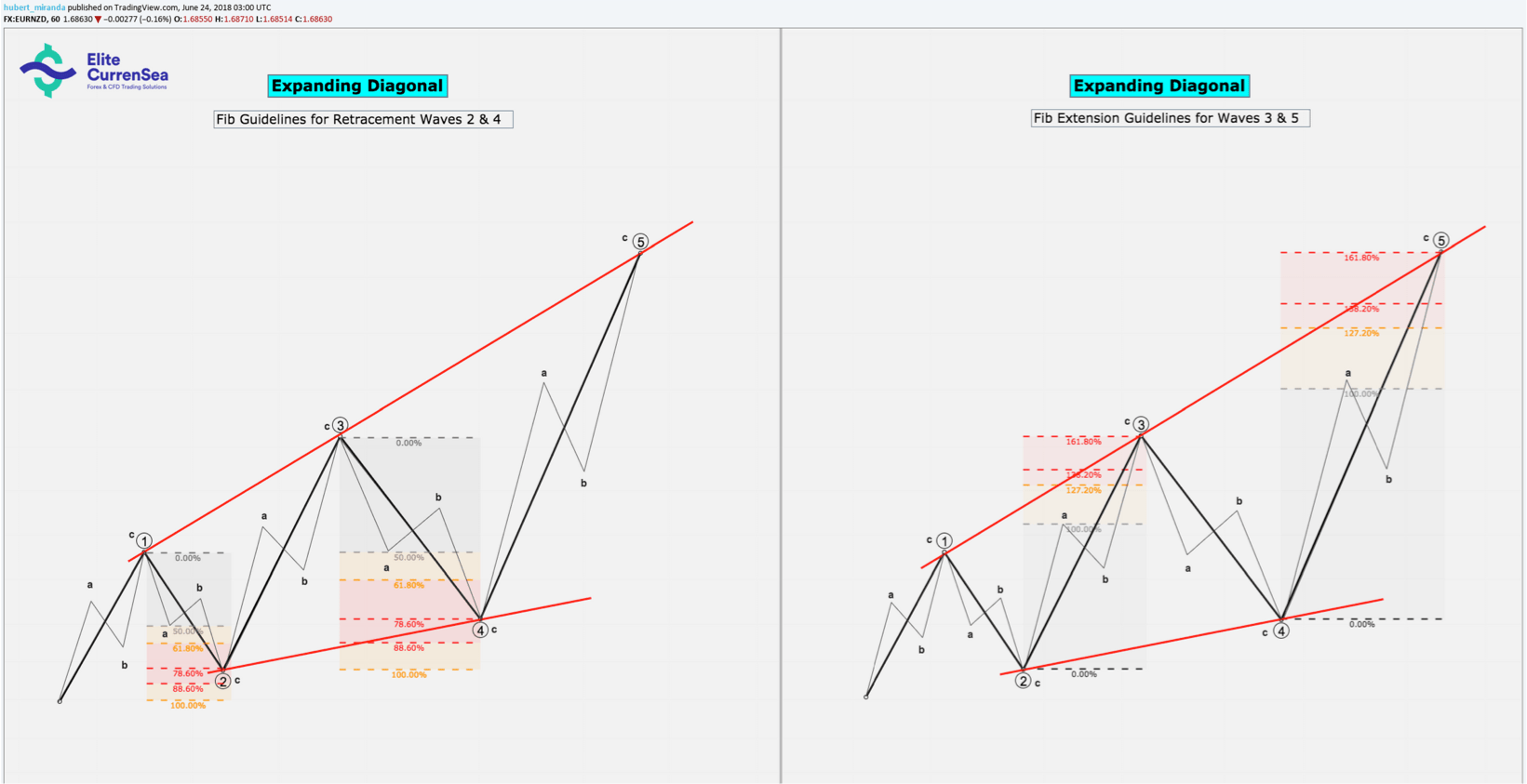

Corrective Wave: FLAT

Rules:

- All flats consist of 3 waves (ABC)

- Wave A and B must subdivide into any corrective pattern, but Wave A cannot be a triangle

- Wave C must be a motive wave (i.e impulse or diagonal)

- Wave B must retrace wave A by at least 90%

Guidelines:

- The structure is called an ‘Expanding” Flat if Wave B retraces between 105% – 138% of wave A, and Wave C ends anywhere beyond the end of wave A. Expanding Flats occur most commonly.

- The structure is called a ‘Regular‘ Flat, if wave B retraces between 90 %- 105% of wave A, and the size of wave C is 100% – 105% of wave A. Regular Flats are more rare.

- The structure is called a ‘Running’ Flat if Wave B ends beyond the start of wave A, but wave C fails to reach beyond the end of wave A. Running Flats are very rare and alternative wave counts should therefore always be considered before labeling anything as a running flat, especially on larger scales.

- Whenever an impulse (trend) ends in what looks like a 3-wave swing and then reverse sharply, be mindful that it could be an expanding flat and that the old trend direction may resume suddenly.

Fibonacci Retracement and Extension Guidelines:

- Refer to image for main retracement and extension targets.

- Wave C is usually 100% – 161.8% x Wave A in size, but it is possible that it becomes as big as 261.8% on rare occasions. Sometimes the target for wave C can also be gauged by using the start of Wave A as the base for the 161.8% extension target (instead of using the start of wave C as the base). This method creates a slightly different price level and broadens the target area a little

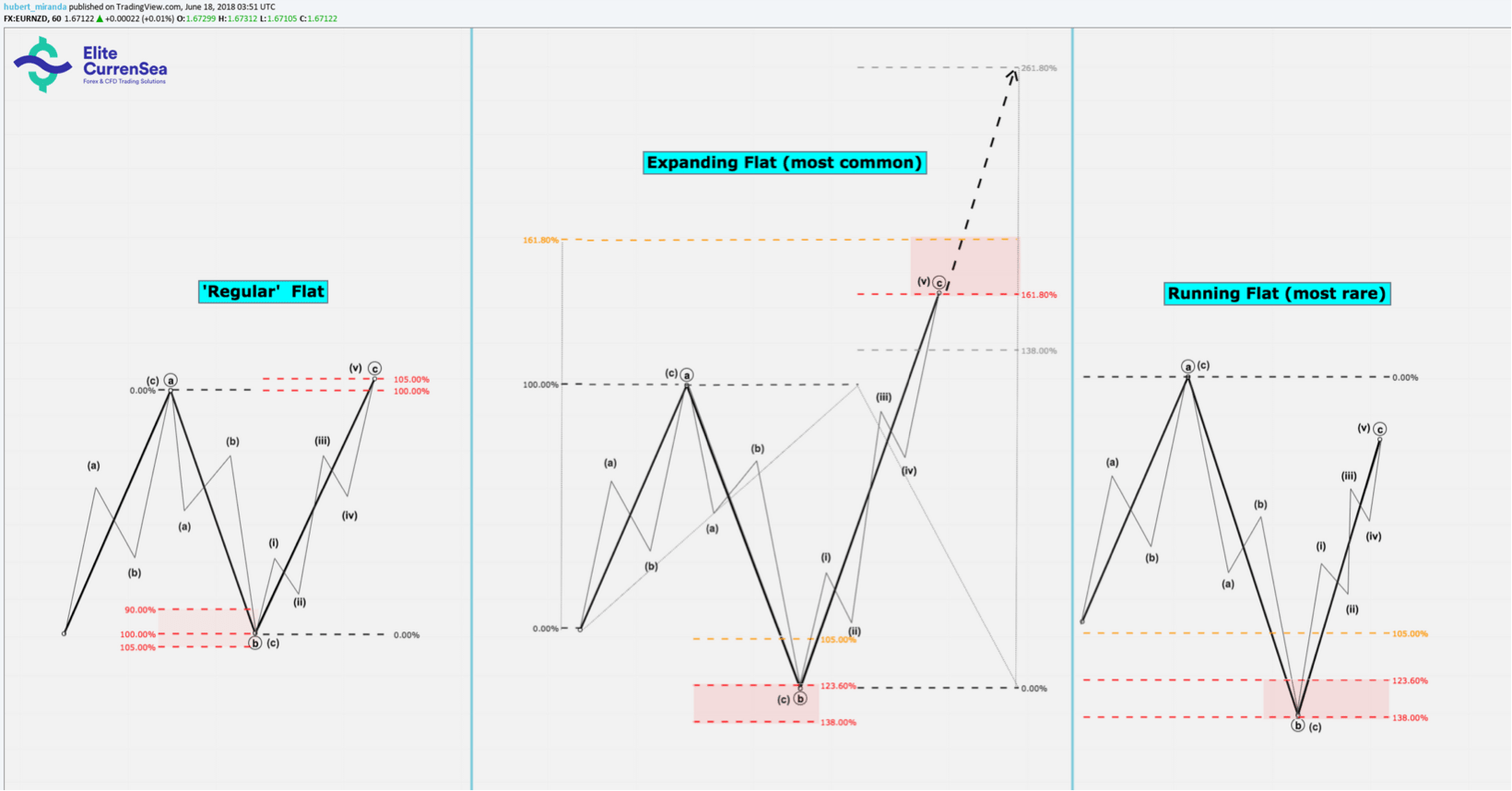

Corrective Wave: TRIANGLE

Note: The internal zigzag structure is only shown it the Contracting Triangle example in order to avoid clutteringthe drawing with too many lines. Please be aware that all waves within all triangles consist of corrective wave patterns, even if they are not shown in the image.

Note: The internal zigzag structure is only shown it the Contracting Triangle example in order to avoid clutteringthe drawing with too many lines. Please be aware that all waves within all triangles consist of corrective wave patterns, even if they are not shown in the image.

Rules:

- A triangle consists of 5 corrective waves (ABCDE)

- A triangle can only appear in the position of wave 4 of an impulse, wave B/X of zigzags and flats , wave Y of double three sideways corrections, or wave Z of triple three sideways corrections.

- At least 4 of the 5 waves subdivide into zigzags.

- A triangle never has more than one complex wave. The complex wave within a triangle can only be a double/triple zig-zag or a triangle itself.

- In contracting & barrier triangles, Wave C does not move beyond wave A, wave D does not move beyond wave B, and wave E does not move beyond wave C. This results in two converging trend lines forming as the triangle progresses. The main difference between a barrier triangle is that it creates a virtually horizontal trend line between points B and D.

- In an expanding triangle, Waves B, C, D, and E must retrace at least 100% of the previous wave, but no more than 150%. This results in two diverging trend lines forming formed as the triangle progresses.

Guidelines:

- In a contracting triangle, wave B can end beyond the start of wave A (about 60% of the time). The structure is then called a ‘Running’ Contracting Triangle (see image)

- Wave E will quite likely undershoot or overshoot the triangle trend line. This is normal.

- Expanding triangles and barrier triangles are much more rare than contracting triangles.

- Often, one of the waves becomes complex. It tends to be wave C or D that turns into a complex zigzag (double/triple). Sometimes wave C, D, or E turns into a barrier or contracting triangle by itself. If the final wave E turns into a triangle, the whole structure appears to extend into 9 waves, which become ever more narrow. The triangle then gets labeled as A-B-C-D-E-F-G-H-I

- During contracting and barrier triangles, momentum and volume decreases

- There is usually a (wave 5) post-triangle thrust after wave E is finished, which will roughly be the same size as the width of the trend lines at the start of the triangle.

- The (wave 5) post-triangle thrust in commodity prices is usually the longest wave of the entire trend.

Fibonacci Retracement and Extension Guidelines:

- In a contracting or barrier triangle many waves have a 61.8% – 78.6% relationship to the previous wave or alternating wave

- In running triangles, wave B should retrace wave A no more than 161.8%

- In an expanding triangle, wave C is usually 161.8% of wave A , wave D is 161.8% of wave B, and wave E is 161.8% of wave C

- See image for more details

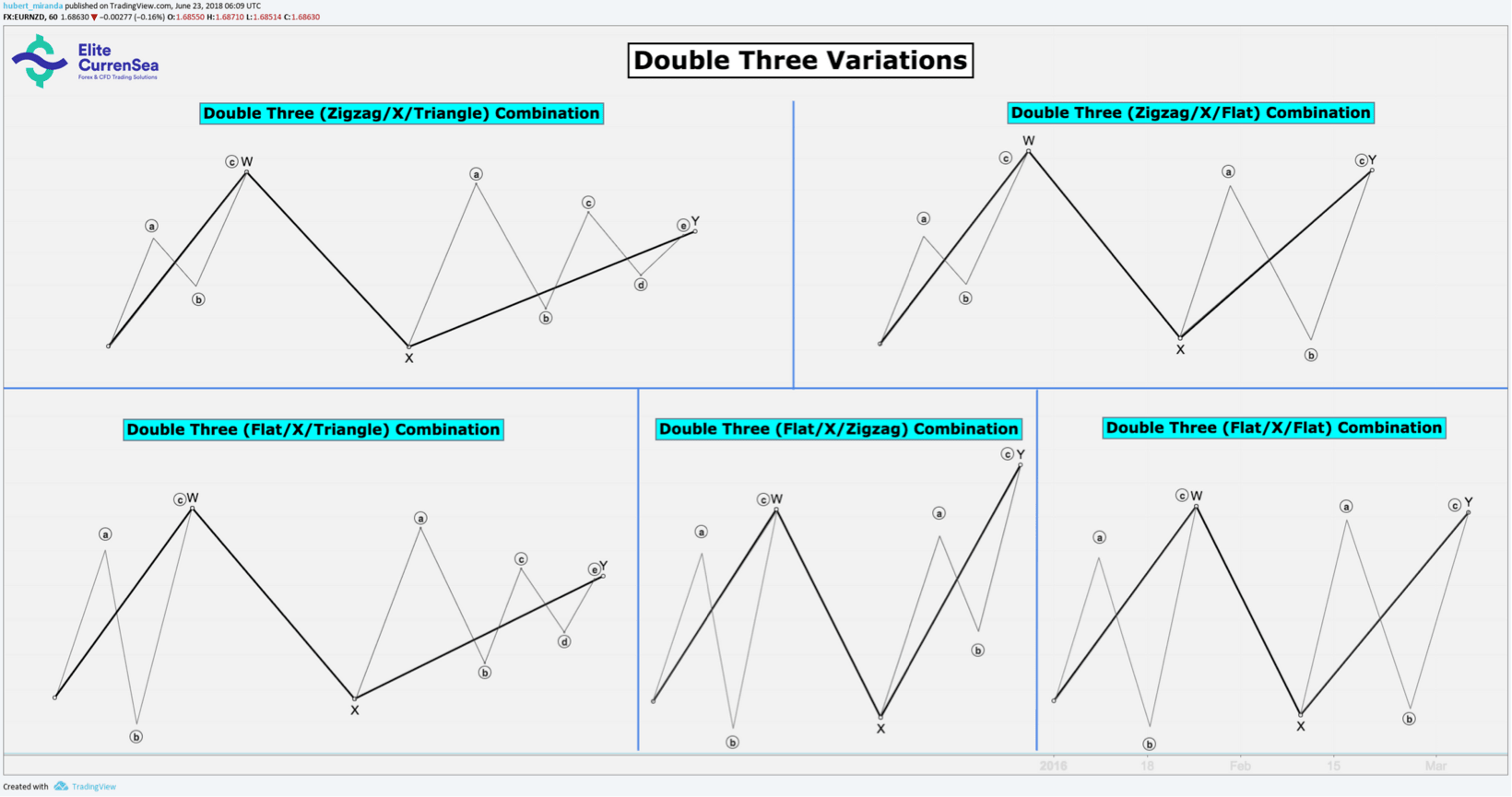

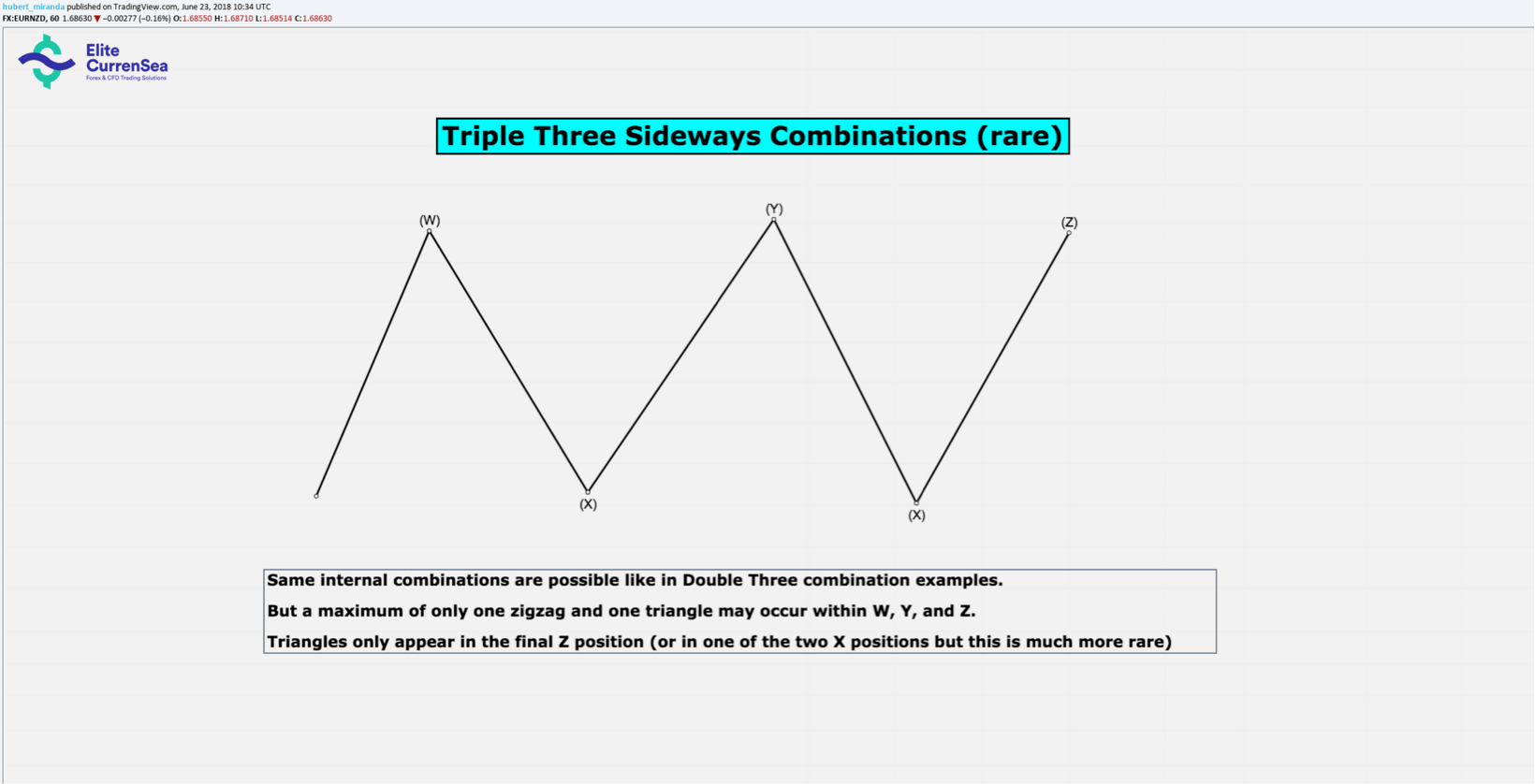

Corrective Wave: COMPLEX COMBINATIONS

(Please note that complex ZigZag combinations are covered under the Zigzag section earlier on. The following section only deals with complex sideways combinations)

- A complex sideways combination consists of three or five corrective patterns, which alternate in their orientation, thereby creating a complex sideways motion. The central, dividing corrective patterns (X waves) always orientate in the direction of the previously established trend. A ‘Double Three’ combination is therefore essentially made up of 3 corrective patterns (W-X-Y) in alternating directions, and a ‘Triple Three’ combination consists of 5 corrective patterns (W-X-Y-X-Z) in alternating directions.

- A double-three can have the following combination of corrections:

- zig-zag (W), any corrective wave (X) and flat (Y)

- zig-zag (W), any corrective wave(X) and triangle (Y)

- flat (W) any corrective wave (X), and triangle (Y)

- flat (W), any corrective wave (X), and flat (Y)

- flat (W), any corrective wave (X), and zig-zag (Y)

- Double Threes are only allowed to have a maximum of one zigzag and one triangle in the W and Y positions. But wave X can be any corrective pattern in addition (including double or triple three combinations of a smaller degree!).

- A Triple Three works in the same manner as a Double Three, and it also only allowed to have one zigzag and one triangle in the W, Y, and Z positions. X waves in a Triple Three can be any corrective patterns in addition (including double or triple three combinations of a smaller degree!)

- Triangles are only allowed to form in the final wave of the combination sequence (i.e. in a Double-Three during wave Y, or in a Triple Three during wave Z).

- IMPORTANT NOTE: Opinions differ amongst Elliott Wave researchers over whether or not waves W, Y, and Z are also allowed to be complex combinations within themselves (e.g. a smaller wxy within W, and so on). The original research presented that W, Y and Z each need to be able to be broken down into a simple corrective pattern (i.e. zigzag, flat, or triangle) at the next smaller degree, and only X-waves could in principle sprout smaller combinations inside themselves. However, some modern analysts are proposing that market behaviour is more complex these days and are validating potentially labelling smaller complex corrections inside W, Y and Z as well. Personally, I have so far not found any use by further complicating the potential of wave W, Y and Z. In the contrary, I have found that it can lead to ‘over-labelling’ of corrections and cause misjudgements in regards to the start of trend continuation or correction targets. If you are starting out with Elliott Waves, I would recommend to stay with the original rules that W, Y and Z should be able to be broken down into simple corrections patterns.

Guidelines:

- Triple Threes are very rare compared to Double Threes

- Even though X waves could in theory also be a triangle, in addition to a triangle in the final wave of a combination, this has never occurred and most likely never will, simply due to the underlying market dynamics. Therefore the final Y or Z will almost certainly never be another triangle, if an X-wave was already a triangle.

- Expanding triangles are extremely rare within a complex combination and have probably never been witnessed (as far as is publicly known

Fibonacci Retracement and Extension Guidelines:

- Sideways combinations are by their nature range bound. Generally, all waves retrace each other around 78% – 138%, creating either a virtually horizontal movement, or a channel that is very gently sloping against the previous trend direction.

Guide Created and Compiled by Hubert Miranda Follow on Twitter: @miranda_hubert

8

Leave a Reply

8

Hi I found your explanation on EW extremely helpful. Would you know any EW software that can help us in trading FX markets?

Hi Daniel! We have a EW based trading system SWAT, you can find more information about it here: https://www.elitecurrensea.com/wave-analysis-trading-swat/

Hi! this info is really cool and helpful, do you have a time relationships guide for waves? like most common duration in time for corrections to an impulse for example.

Thanks!!

Hi Daniel, thank you! We do not have a time guide yet but makes a lot of sense to me, will try to make one soon 🙂

Thanks! it will improve our price and time analysis in Elliott wave basis. Hope you have the time to do it!

good information , the best

Thank you! We appreciate it 🙂

Thank you so much for this! This has been my go to guide for wave analysis. I like the new design too! Thanks for putting in so much effort into building this page. I have told a couple of my friends who are new to trading to use this page to learn everything about analysing the market. Your efforts are much appreciated. Cheers!